Last Updated on: 14th November 2024, 06:28 am

Navigating VAT obligations is crucial for businesses in the UK, especially those new to the process or expanding their operations. Many business owners find themselves asking questions like “What exactly is VAT?” and “How does the VAT return process work?”.

VAT returns are an essential part of the financial landscape for any VAT-registered business, and understanding the filing requirements, deadlines, and procedures can make a significant difference in staying compliant.

This guide provides a detailed look at VAT returns in the UK, offering insights on who needs to submit them, the registration process, reporting requirements, and step-by-step instructions for accurate and timely submissions.

What Is a VAT Return and Why Is It Important for UK Businesses?

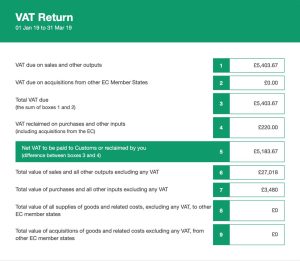

A VAT return is a financial report submitted by VAT-registered businesses to HM Revenue and Customs (HMRC). This report details the total VAT collected on sales and the VAT paid on purchases, known as output VAT and input VAT, respectively. A VAT return aims to calculate whether a business owes VAT to HMRC or is eligible for a VAT refund.

VAT returns are required for most businesses operating in the UK that meet specific turnover thresholds or choose to register voluntarily. These returns are essential for maintaining compliance with tax laws and ensuring the accurate reporting of sales and purchases.

Failing to submit accurate and timely VAT returns can lead to penalties, fines, and complications with HMRC. Furthermore, VAT returns provide a transparent record of a business’s taxable transactions, creating a clear picture of its VAT liability or entitlement to refunds. VAT management also impacts cash flow, as businesses can reclaim VAT on eligible expenses, reducing overall tax liability.

Who Needs to Submit a VAT Return in the UK?

Image – Source

Not every business in the UK is required to submit VAT returns. The requirement to file VAT returns applies to specific types of businesses, generally determined by the amount of taxable turnover and the nature of their products or services.

- Threshold Requirements: Businesses with an annual taxable turnover exceeding £85000 are legally required to register for VAT and submit VAT returns to HMRC. The taxable turnover includes revenue from most goods and services sold within the UK, excluding VAT-exempt items. Businesses that fall below this threshold are not obligated to register or file VAT returns but may still choose to do so under certain conditions.

- Voluntary Registration: Some businesses with lower turnover may voluntarily register for VAT. This option is often advantageous for businesses that regularly incur VAT on expenses, as it allows them to reclaim input VAT. This approach can be beneficial for cash flow, as the reclaimed VAT reduces the net VAT liability. Voluntary registration can also enhance the credibility of a business, as some clients prefer to work with VAT-registered suppliers.

- Exemptions: Businesses that solely provide VAT-exempt goods or services are generally exempt from VAT registration. These services may include financial services, education, health and medical care, and some cultural services. Exempt businesses cannot reclaim VAT on their purchases, and they are not required to submit VAT returns.

How Do You Register for VAT and Prepare for Your First Return?

For businesses that are required to or choose to register for VAT, the registration process with HMRC is the first step in meeting VAT obligations.

After registration, businesses need to set up an accounting system that ensures accurate VAT tracking for sales and purchases, preparing them for their first VAT return.

Step 1: Assess Eligibility and Decide on Registration

- To determine whether VAT registration is necessary, businesses should calculate their taxable turnover over the past 12 months. If the turnover exceeds £85000, registration is mandatory. Voluntary registration can also be an option if the business incurs a high amount of input VAT and wishes to reclaim it.

- It is important to assess the long-term financial impact of VAT registration. Businesses should evaluate how VAT registration might affect their pricing, sales, and client relationships.

Step 2: Register for VAT with HMRC

- Create a Government Gateway Account: To register for VAT online, businesses must create an account on the Government Gateway, which will be used for all HMRC-related filings, including VAT returns.

- Submit Business Details: The online VAT registration form requires information about the business, such as the business name, address, owner’s details, and anticipated turnover. HMRC may also request additional documentation to verify the business’s VAT registration eligibility.

- Receive VAT Registration Confirmation: Once the registration process is completed, HMRC will issue a VAT registration certificate, usually within 10 to 14 days. The certificate includes the business’s unique VAT number, the effective date of registration, and the filing periods for VAT returns.

Step 3: Set Up an Accounting System to Track VAT

- After receiving VAT registration confirmation, businesses must set up an accounting system capable of tracking VAT on both sales and purchases. Many UK businesses use accounting software which automatically calculates VAT and integrates with HMRC’s systems.

- Accurate tracking is crucial for VAT reporting. Businesses should record every sale and purchase, along with the corresponding VAT amounts. Establishing a system for organizing invoices, receipts, and VAT records from the outset can prevent errors and ensure smooth VAT submissions.

How Often Do You Need to Submit a VAT Return in the UK?

Most VAT-registered businesses are required to submit VAT returns quarterly, meaning they report VAT every three months. However, alternative submission frequencies are available based on specific needs, such as monthly returns for regular VAT refunds or annual returns for small businesses seeking simplified reporting.

| Submission Frequency | Description | Advantages |

|---|---|---|

| Quarterly Returns | Standard filing frequency, with four returns per year | Commonly used, balanced approach to VAT reporting |

| Monthly Returns | Optional for businesses expecting regular VAT refunds | Provides faster VAT reclaim, enhancing cash flow |

| Annual Returns | Allows one return per year under the Annual Accounting Scheme | Reduces paperwork and simplifies VAT reporting |

VAT return deadlines are typically one month and seven days following the end of the VAT period. Businesses under quarterly filing, for example, would submit their first quarter’s return by May 7 if the period ends on March 31.

What Information Do You Need to Include in a VAT Return?

VAT returns require businesses to report key figures, which include total sales, total purchases, and VAT amounts collected and paid.

The information should be complete and accurate, as any discrepancies may lead to HMRC inquiries, penalties, or adjustments.

- Total Sales (Output VAT): The total value of VAT charged on goods and services sold to customers within the VAT period. Output VAT is calculated based on sales invoices and must reflect the standard or reduced VAT rates applied to the business’s products or services.

- Total Purchases (Input VAT): The total VAT incurred on purchases directly related to the business’s operations. Only VAT on business-related purchases can be reclaimed as input VAT, and personal expenses are excluded from the calculation.

- Adjustments or Corrections: If a previous VAT return contained errors or omissions, adjustments should be made in the current return. This includes both under-claimed and over-claimed VAT amounts. It is important to note that errors exceeding ten thousand pounds require immediate notification to HMRC.

Documentation Requirements

Accurate VAT reporting relies on organized documentation. To support the figures reported in the VAT return, businesses should maintain:

- Sales Invoices: Detailed invoices showing VAT charges for every sale, including customer information, VAT amount, and applicable VAT rates.

- Purchase Receipts and Invoices: Documentation of all purchases with input VAT, ensuring each purchase is related to business operations.

- VAT Account: A record that tracks all VAT paid and collected during the reporting period, helping the business reconcile totals in the VAT return.

What Are Eligible Expenses and How Can You Claim Input VAT?

Eligible expenses for VAT reclamation include goods and services directly related to the business. Input VAT can be claimed on these purchases, reducing the business’s net VAT liability.

Examples of Eligible Expenses

Eligible expenses often include the following, provided they are solely for business use:

- Office supplies and equipment

- Raw materials used in production

- Professional services like legal or accounting fees

- Travel expenses, including fuel and accommodations for business purposes

Steps to Claim Input VAT

- Organize and Record All Purchases with VAT Receipts: Retain VAT invoices and receipts as evidence. These documents must clearly display VAT details for each purchase.

- Ensure Purchases Are Business-Related: Only expenses directly associated with business activities are eligible for input VAT. Personal or non-business expenses do not qualify.

- Claim Input VAT on the VAT Return: Report the input VAT amount on the VAT return form. This input VAT is subtracted from the output VAT to determine the net VAT due to or from HMRC.

Input VAT claims help businesses offset their VAT liability, improving cash flow, especially for businesses with high operational costs.

How Do You Calculate the VAT You Owe or Are Entitled to Reclaim?

Calculating the net VAT involves determining the difference between output VAT and input VAT. Output VAT is the total VAT collected on sales, while input VAT is the VAT paid on business-related purchases. The net VAT, or the amount payable or reclaimable, is calculated as follows:

| Category | Amount (GBP) | VAT Rate (percent) | VAT Amount (GBP) |

|---|---|---|---|

| Sales (Output VAT) | 10,000 | 20% | 2,000 |

| Purchases (Input VAT) | 5,000 | 20% | 1,000 |

| Net VAT | 1,000 owed |

In this example, the business collected £2,000 in VAT on sales but paid £1,000 in VAT on purchases. This results in a net VAT liability of £1,000 owed to HMRC. To calculate these figures accurately, you can use our VAT calculator. If the input VAT (VAT on purchases) exceeds the output VAT (VAT on sales), the business is entitled to reclaim the difference from HMRC.

How Can You Submit Your VAT Return Online?

Since the implementation of Making Tax Digital, or MTD, VAT returns must be submitted online through HMRC’s online portal or compatible accounting software.

The online submission process ensures accuracy and compliance, reducing the likelihood of errors. Businesses can log in to their VAT account, enter required VAT figures, and submit the return electronically.

What Are the Steps to Complete a VAT Return Using HMRC’s Online Portal?

- Log in to Your VAT Account: Access the Government Gateway and log in to your VAT account using your credentials.

- Select the Relevant VAT Period: Choose the VAT period for which you are submitting the return.

- Enter Required Details: Enter total sales, purchases, output VAT, and input VAT figures based on records and calculations.

- Review and Confirm Submission: Verify all details before submitting. This step is crucial, as incorrect information may require corrections or adjustments later.

What VAT Schemes Are Available in the UK, and How Do They Affect Your Returns?

Several VAT schemes exist to simplify the VAT process and provide flexibility for different business needs.

- Flat Rate Scheme: A simplified scheme where businesses pay a fixed percentage of their turnover as VAT. It is ideal for small businesses with limited input VAT, as they do not reclaim input VAT separately.

- Cash Accounting Scheme: Under this scheme, VAT is recorded only when payments are received or made, rather than when invoices are issued. This is advantageous for businesses that experience cash flow fluctuations.

- Annual Accounting Scheme: Instead of quarterly filings, businesses using this scheme file one VAT return annually. Interim payments are made throughout the year based on estimated VAT.

Selecting the right VAT scheme depends on the business’s transaction volume, cash flow, and administrative preferences.

What Is Making Tax Digital (MTD) and How Does It Affect VAT Returns?

Making Tax Digital, commonly referred to as MTD, is a transformative initiative introduced by the UK government to modernize and streamline the tax filing process.

This program was implemented to reduce errors in VAT reporting, simplify compliance, and ensure that VAT returns are handled more efficiently.

MTD requires that all VAT-registered businesses above the VAT threshold (currently £85,000 in annual taxable turnover) maintain their VAT records digitally and submit VAT returns through compatible software that integrates directly with HMRC systems.

This requirement is a significant shift from the traditional paper-based or manual methods, aiming to minimize human error and improve the accuracy of VAT reporting.

Key impacts of MTD on VAT Returns:

- Digital Record-Keeping: Businesses are required to use MTD-compatible software to maintain all VAT-related records electronically. This digital approach includes all invoices, receipts, and VAT transactions, making it easier to track and organize VAT data.

- Automated Calculations and Submissions: MTD-compliant software can automatically calculate VAT amounts and compile this information into a format that’s ready for submission to HMRC. This reduces the risk of calculation errors, which could otherwise lead to incorrect VAT returns and potential penalties.

- Improved Compliance and Reduced Errors: MTD aims to streamline VAT processes and reduce common errors in submissions by replacing manual record-keeping with digital systems. By automating much of the process, MTD minimizes the risk of input errors, calculation mistakes, and missed deadlines.

- Mandatory Software: MTD requires businesses to use approved software that integrates with HMRC’s systems. Popular accounting software like QuickBooks, Xero, and Sage are MTD-compliant, making it easy for businesses to stay aligned with digital submission requirements.

MTD not only simplifies the VAT return process for businesses but also ensures that HMRC has access to more accurate and timely data, reducing the need for audits and follow-up inquiries. It’s a progressive move toward fully digital tax compliance in the UK.

How Do You Pay the VAT Due to HMRC After Submission?

Once a VAT return has been submitted and any VAT owed is calculated, businesses must arrange payment to HMRC. VAT payments are typically due one month and seven days after the end of the VAT period covered by the return. Businesses need to ensure that their payment reaches HMRC by the deadline to avoid late payment penalties or interest charges.

Available Payment Methods

- Direct Debit: Direct Debit can be set up through your VAT online account on HMRC’s website. This method automatically deducts the VAT amount due from your bank account on the payment due date, ensuring timely payments.

- Bank Transfer (BACS or CHAPS): Bank transfers can be arranged through your bank, allowing you to transfer funds directly to HMRC. Make sure to include your VAT registration number as a payment reference for proper allocation.

- Debit or Credit Card: Payments can also be made online using a debit or credit card through the HMRC payment portal. Note that credit card payments may incur a processing fee.

- Standing Order: Some businesses, especially those on the Annual Accounting Scheme, may set up standing orders to make VAT payments in installments throughout the year.

To ensure that payments are timely, businesses should plan ahead, especially if the due date falls on a weekend or bank holiday, as processing times can vary depending on the payment method chosen.

Direct Debit and bank transfers are often preferred because they offer a reliable and prompt way to transfer funds, reducing the chance of missed deadlines.

What Records Do You Need to Keep for VAT Compliance in the UK?

For VAT compliance, HMRC mandates that businesses retain all relevant VAT records for at least six years. These records provide a transparent and comprehensive view of a business’s VAT activities, supporting the accuracy of VAT returns and enabling HMRC to conduct audits if necessary.

Proper record-keeping is not only a legal requirement but also a critical aspect of good financial management.

Essential VAT records to retain include:

- Sales Invoices: Invoices issued to customers should display the VAT amount charged, as well as details of the transaction, including the date, customer information, and VAT rate applied.

- Purchase Receipts and Invoices: Records of business purchases, particularly those on which VAT has been paid and reclaimed, are essential. These receipts or invoices should clearly display VAT amounts and other relevant transaction details.

- VAT Account Records: A VAT account is a running summary of VAT paid and collected during the accounting period, providing a clear overview of a business’s VAT position.

- Digital Records (for MTD Compliance): Under Making Tax Digital, businesses must keep VAT records in digital format using MTD-compatible software. This includes maintaining electronic copies of invoices, receipts, and all supporting VAT documentation in a digital format for ease of tracking and reporting.

Organizing these records is crucial for VAT returns, as they form the basis of VAT calculations and claims. Should HMRC conduct an audit, well-organized and accessible records make the process smoother and minimize potential discrepancies.

How Do You Handle VAT for International Sales and Purchases?

Handling VAT for international transactions requires a clear understanding of the VAT rules that apply to cross-border activities.

VAT obligations vary depending on whether the goods or services are being imported from or exported to EU or non-EU countries, particularly following Brexit.

1. VAT on EU Transactions

- Imports from the EU: After Brexit, UK businesses importing goods from the EU may now be required to account for import VAT. This VAT can be paid at the point of entry, or alternatively, businesses can use postponed VAT accounting to declare and recover VAT on the same VAT return.

- Exports to the EU: Goods exported from the UK to the EU are typically zero-rated for VAT. However, businesses must retain evidence of the goods’ exportation, such as transport documents, to qualify for zero-rating.

2. VAT on Non-EU Transactions

- Exports Outside the EU: Exports to countries outside the EU are generally zero-rated, meaning VAT is not charged on these sales. Similar to EU exports, evidence of exportation is required to substantiate zero-rating.

- Imports from Non-EU Countries: Import VAT is charged on goods imported from non-EU countries, similar to imports from the EU. Depending on the business’s preference and cash flow considerations, this import VAT can either be paid at customs or managed through postponed VAT accounting.

International transactions are subject to specific VAT treatments, and it is essential to document each transaction accurately.

For services, VAT obligations depend on whether the customer is a business or consumer and their location, as VAT rules differ for business-to-business and business-to-consumer transactions in cross-border situations.

Businesses should maintain clear records for all international sales and purchases to ensure compliance and correct VAT treatment.

Conclusion

Effectively managing VAT returns is essential for maintaining tax compliance and ensuring the financial health of a business. From understanding the fundamentals of VAT and registering if required, to preparing accurate returns and managing payments, every step plays a critical role in fulfilling VAT obligations.

The implementation of Making Tax Digital has transformed the way businesses handle VAT, introducing digital requirements that enhance accuracy and streamline the submission process.

By adhering to VAT regulations and utilizing MTD-compliant software, businesses can ensure that they remain compliant with HMRC’s requirements.

Clear record-keeping, timely payments, and careful handling of international VAT obligations can prevent potential issues, allowing businesses to operate smoothly and avoid costly penalties.

Managing VAT compliance not only supports a business’s legal obligations but also builds credibility with clients, suppliers, and regulatory authorities, establishing a foundation for long-term growth and financial stability.

FAQs about VAT Returns in the UK

Can businesses reclaim VAT on expenses, and if so, how?

Yes, businesses can reclaim VAT on expenses directly related to business activities by submitting these claims through their VAT Return.

What records should a business keep to support their VAT Return?

Businesses must keep detailed records of sales, purchases, and VAT invoices to support their VAT Return.

How long are businesses required to keep VAT records?

Businesses are required to keep VAT records for at least six years for compliance purposes.

What are the requirements and process for deregistering from VAT?

To deregister, a business must inform HMRC and meet specific criteria, such as no longer meeting the VAT threshold.

Are there any special considerations for international businesses dealing with UK VAT?

Yes, international businesses need to consider import/export VAT rules and may need a UK VAT registration for transactions.

No Comments

Leave a comment Cancel