Understanding Your Council Tax Bill

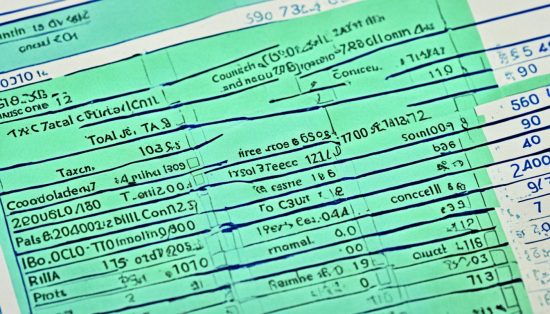

The council tax bill is a crucial document that provides homeowners with a comprehensive understanding of their civic duty and financial obligations towards their local community. This bill outlines the total amount you are required to pay for the year, as well as a detailed breakdown of how this amount has been calculated.

1. Components of Your Council Tax Bill

Your council tax bill typically includes the following key components:

- The total annual council tax charge for your property, which is based on the valuation band your home falls into.

- The percentage change from the previous year’s charges, providing context on any increases or decreases.

- A breakdown of the various elements that make up the total charge, such as amounts owed to the local authority, police, fire, and social care services (known as precepts).

- Any discounts, exemptions, or reductions that have been applied to your account, such as the 25% single occupancy discount.

- Additional charges or penalties, such as those incurred for empty properties or overdue payments.

2. Monthly Payments and Annual Totals

Council tax is usually paid in 10 equal monthly instalments, with the annual bill sent out by the end of March for the year ahead. The bill will clearly display the total amount due for the year, as well as the individual monthly payment amounts and due dates.

3. Assessing Your Payment Dates

It’s important to review your council tax payment dates carefully and ensure that you make your payments on time. If you’re experiencing difficulties in making the payments, you should contact your local council immediately, as they may be able to offer support, such as spreading the payments over 12 months instead of 10.

| Component | Amount | Percentage Change |

|---|---|---|

| Sandwell MBC | £1,200 | +3.5% |

| West Midlands Fire and Rescue Authority | £80 | +2.0% |

| West Midlands Police and Crime Commissioner | £200 | +4.0% |

| Adult Social Care | £100 | +2.5% |

| Total Council Tax | £1,580 | +3.7% |

Who is Required to Pay Council Tax?

Council tax is a mandatory tax paid by residents of residential properties in the United Kingdom. This includes homeowners, tenants, and anyone aged 18 or over living in the property, regardless of their employment status or income level. However, there are some exceptions and discounts that may apply, such as for full-time students or people with disabilities.

The liability for paying council tax is determined by a hierarchy, with the owner of the property being the primary responsible party. Resident freeholders, who live in the property they own, are at the top of this hierarchy. Statutory or secure tenants of housing associations, as well as private tenants with a formal tenancy agreement, are also required to pay council tax.

Even individuals living in a property without a legal right to do so, such as grown-up children, are obligated to contribute to the municipal dues. Additionally, non-resident property owners may still have a liability for council tax, particularly in cases of “houses in multiple occupation.”

The council tax liability is a collective responsibility, and in situations where there are multiple individuals with an equal interest in a property, such as married or unmarried couples living together, they will be jointly liable for the civic duty payments.

| Council Tax Valuation Bands | Property Value Range (as of April 1, 1991) |

|---|---|

| Band A | Up to £40,000 |

| Band B | Over £40,000 and up to £52,000 |

| Band C | Over £52,000 and up to £68,000 |

| Band D | Over £68,000 and up to £88,000 |

| Band E | Over £88,000 and up to £120,000 |

| Band F | Over £120,000 and up to £160,000 |

| Band G | Over £160,000 and up to £320,000 |

| Band H | Over £320,000 |

The property levy in the UK is categorised into different valuation bands based on the value of the residential property as of April 1, 1991. These bands range from Band A (up to £40,000) to Band H (over £320,000), and the domestic contribution amount payable varies accordingly.

It’s important to note that the who pays council tax rule extends beyond just homeowners and tenants. In certain situations, such as houses in multiple occupation, care homes, or properties inhabited by asylum seekers, the owner of the property may be responsible for the residential tax payments.

How to Pay Council Tax in UK?

Paying your council tax in the UK is a straightforward process with several convenient options available. Whether you prefer the ease of setting up a direct debit, the flexibility of online payments, or the accessibility of cash payments at local retail outlets, there are multiple ways to fulfil your civic duty of contributing to your community’s municipal dues.

1. Online Payment Methods

Making your council tax payments online is a popular and efficient choice. Many local authorities in the UK offer the option to pay your residential tax or property levy via their website. This typically involves inputting your account details and selecting your preferred payment method, which may include Visa Credit, Visa Debit, UK Maestro, International Maestro, Mastercard, Electron, and JCB.

2. Direct Debit: The Easiest Option

For those who value the convenience of set-and-forget payments, setting up a direct debit is an excellent choice. This allows your local council to automatically collect your council tax or domestic contribution on the agreed dates, which can be the 1st, 7th, 15th, 21st, or 28th of each month. Payments can be spread over 10 or 12 instalments, making budgeting easier for your rates bill or local taxation.

3. Alternative Payment Facilities: Paypoint, Payzone, and Quickcards

For those who prefer to make cash payments, Paypoint, Payzone, and Quickcards offer convenient in-person payment options at post offices, banks, newsagents, and other local retail outlets. Simply present your council tax bill, complete with the necessary barcode, and make your civic duty or community charge payment at least seven days before the due date.

Regardless of your preferred payment method, paying your local authority rates on time is an essential part of being a responsible member of your community. By exploring the various options available, you can ensure that your pay council tax online or offline, fulfilling your civic duty with ease.

Pay Council Tax: Help and Support Options

Paying your council tax can sometimes be a challenge, but there are various options available to help you manage your residential tax obligations. Whether you’re facing payment difficulties or have inadvertently overpaid, your local council is there to provide support and guidance.

1. Contacting Your Local Council for Payment Difficulties

If you’re experiencing council tax payment difficulties, it’s crucial to contact your local council as soon as possible. They can offer a range of solutions to help you get back on track, such as:

- Spreading your payments over 12 months instead of the standard 10 months

- Offering alternative payment arrangements tailored to your financial situation

- Providing advice on local authority support and civic duty discounts you may be eligible for

By proactively communicating with your council, you can avoid potential penalties and ensure your municipal dues are manageable.

2. What to Do if You’ve Overpaid Council Tax

If you’ve overpaid your council tax, don’t worry – your local council can help you rectify the situation. Simply contact them and request a refund. They’ll review your rates bill and domestic contribution history to determine if you’re entitled to a reimbursement.

In some cases, your council may even be able to automatically apply the overpaid council tax towards your future property levy payments, streamlining the process. Be sure to keep an eye on your local taxation statements to avoid any inadvertent overpayments.

Remember, your local council is there to help you navigate the residential tax landscape and ensure you’re fulfilling your civic duty in the most efficient and stress-free manner possible.

Conclusion

Paying council tax in the UK is a crucial civic duty for residents. By understanding your council tax bill, exploring various payment methods, and seeking support when needed, you can efficiently manage this local authority rates and fulfil your responsibilities as a UK resident.

Whether you opt for the convenience of Direct Debit or explore alternative payment facilities, staying on top of your residential tax obligations is essential. Furthermore, being aware of the available help and support options can make navigating any property levy or municipal dues challenges much easier.

Ultimately, paying your domestic contribution to the local taxation system is a shared responsibility that benefits the entire community. By embracing this rates bill as a community charge, you can play your part in supporting the essential services and infrastructure that make the UK a great place to live.

FAQ

1. What is council tax and who is required to pay it in the UK?

Council tax is a mandatory local authority tax levied on residential properties in the UK. It is paid by residents, including homeowners, tenants, and anyone aged 18 or over living in the property, regardless of their employment status or income level. Some exceptions and discounts may apply, such as for full-time students or people with disabilities.

2. How can I pay my council tax in the UK?

There are several convenient ways to pay your council tax in the UK. The easiest option is to set up a direct debit, which allows your local council to automatically collect the payments from your bank account on the agreed dates. Alternatively, you can pay your council tax online, or use cash payment facilities such as Paypoint, Payzone, and Quickcards at post offices, banks, newsagents, and convenience stores.

3. What information is included in my council tax bill, and how can I understand it?

Your council tax bill provides essential information, including the total amount you need to pay for the year and how this amount has been calculated. The bill typically outlines the monthly payment schedule, which is usually split into 10 equal instalments. It’s important to review your payment dates and contact the local council immediately if you’re experiencing difficulties in making the payments, as they can offer support, such as spreading the payments over 12 months instead of 10.

4. What should I do if I’m experiencing difficulties in paying my council tax?

If you’re experiencing difficulties in paying your council tax, it’s important to contact your local council immediately. They can provide support, such as spreading your payments over 12 months instead of 10, or offering other options to help you manage your civic duty. Additionally, if you’ve overpaid your council tax, you should contact your local council to request a refund.

No Comments

Leave a comment Cancel